Not many own loan lenders will approve you for a personal loan by using a 561 credit score rating. Nevertheless, there are a few that work with bad credit history borrowers. But, personalized loans from these lenders include higher interest costs.

Experian is really a globally recognized money chief devoted to assisting numerous individuals acquire control of their funds through specialist assistance and ground breaking instruments. A trusted platform for funds management, credit score education and learning, and id safety, our mission would be to deliver fiscal electricity to all.

It might be tempting to go along with a credit history repair service firm for A fast repair. Bear in mind that these could be high-priced, and at times firms that promote these types of companies might make deceptive statements about the things they can do to suit your needs.

A lot of future property consumers presume that the credit score have to be during the 600s or 700s to obtain a home loan. This really is unquestionably not the case, as a lot of property finance loan lenders will give home loans to borrowers with credit history scores as low as 500. In case you have a 561 credit rating rating, the subsequent loan selections may very well be available to you.

There’s no unique minimum credit score rating necessary to qualify for just a motor vehicle loan. Still, For those who have poor credit score, it could be difficult to get authorized for just a motor vehicle loan. Despite having the ideal car loans for lousy credit score, Be careful for prime curiosity fees, which can make it pretty expensive to borrow funds.

When you've compensated off the loan, you obtain usage of The cash as well as the amassed interest. It is partly a savings Device, but the true gain arrives as the credit union reviews your payments into the countrywide credit history bureaus. As long as you make normal on-time payments, the loan may lead to credit history-rating advancements. (Before obtaining a credit history-builder loan, be sure the credit history union experiences payments to all a few nationwide credit rating bureaus.)

It is not hard to learn when you qualify for a property finance loan. We can assist match you which has a mortgage lender that assists borrowers that has a 561 credit rating rating. They're able to guide you in determining your eligibility for the home finance loan. To possess a home finance loan lender Speak to you, be sure to fill out this way.

Quite a few lenders opt for never to do business with borrowers whose scores tumble in the Pretty Weak range, on grounds they've got unfavorable credit rating.

Figuring out what exactly goes into your credit score scores is often challenging. With all the several credit score variables — like payment background as 561 loan well as the age and variety of your accounts — that could make up Just about every credit rating score, there’s no one way to Establish your credit rating. The trail that’s best for you depends on your unique credit rating profile.

And it commonly usually takes scores seven-a decade to totally recover. Sadly, there’s no way to lessen the effect. However you can speed up the method by putting a deposit on the secured credit card and locking it in a drawer, or creating purchases and paying the Monthly bill by the due date every month.

A smart way to begin build up a credit history rating is to get your FICO® Rating. Together with the rating alone, you'll get a report that spells out the most crucial occasions with your credit rating background which have been lowering your rating.

Unfortunately, hire and utility payments aren’t usually described to your 3 credit score bureaus. Even so, for a small charge, lease reporting expert services will increase your payments on your credit rating report, which will assist you to boost your credit rating scores. Crucial Aspects That Condition Your FICO® Rating

No, the minimum amount credit history rating essential for an automated approval for USDA loan is a 640. Often credit rating scores underneath a 640 are accredited, nevertheless it would require a guide approval.

Real phrases could vary. Right before publishing an software, often validate all stipulations Using the supplying establishment. Remember to let's know in case you notice any discrepancies.

Alana "Honey Boo Boo" Thompson Then & Now!

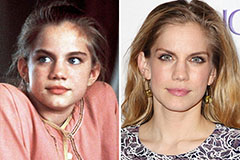

Alana "Honey Boo Boo" Thompson Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Rachael Leigh Cook Then & Now!

Rachael Leigh Cook Then & Now! Brooke Shields Then & Now!

Brooke Shields Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now!